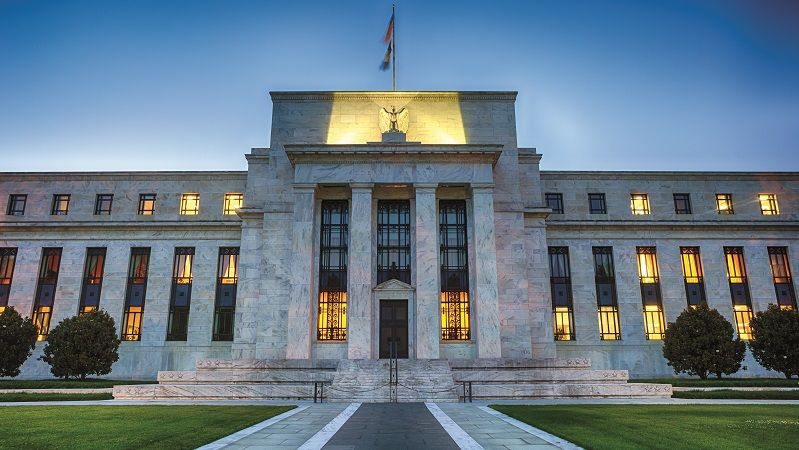

Fed holds fire again as Powell strikes more dovish tone

The Federal Reserve held the US base rate steady again last night at a 22-year peak of 5.25–5.5%, as widely expected, writes Alex Sebastian. While the decision to leave rates unchanged was no surprise, Chair Jerome Powell’s accompanying commentary was where the interesting elements were found. While once again reiterating the Fed’s determination to bring…