Biotechnology has become the hot ticket of the medical world in this century. In recent years, every second drug approved by regulators has emerged from the lab of a biotech company. According to market research firm IMS Health, 30-40 new biotech drugs will be approved every year in the US and Europe going forward from 2018. By increasing the partnership between technology and pharmaceuticals, the sector has an impressive estimated growth rate of more than 10% per year.

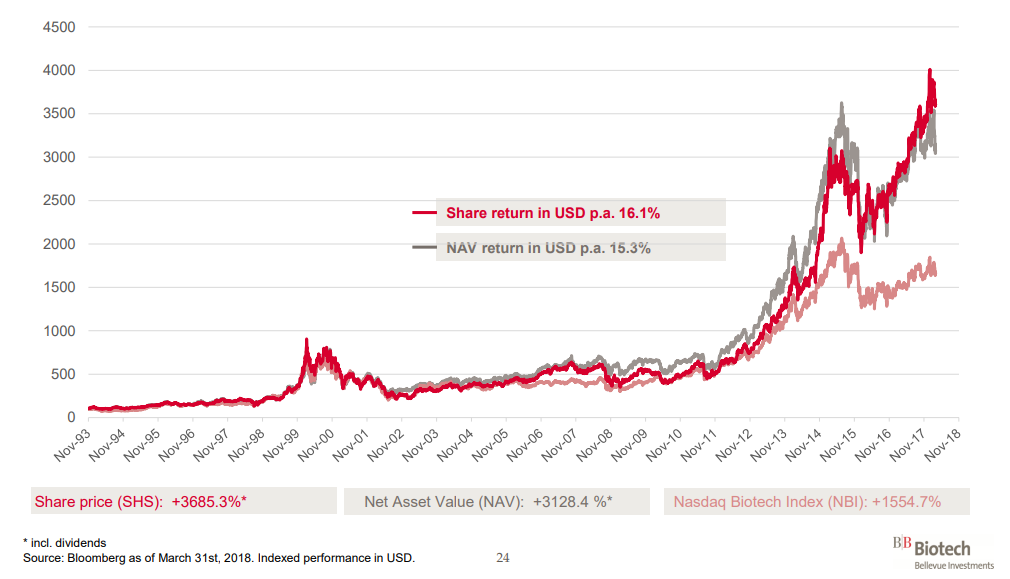

Since launching in 1993, BB Biotech has delivered consistent growth whilst returning considerable value to investors. By investing in innovative biotech firms that target serious illnesses, whose needs are largely unmet by wider markets, BB Biotech has achieved an annualized share return of around 14% (in CHF). The share price has risen by more than 30% over the last three years and more than 250% over the last five years (in CHF, as of May 29, 2018), thus significantly outperforming the benchmark Nasdaq Biotech Index.

Untapped potential

To achieve these impressive returns, the team must be extremely rigorous when looking at new investment opportunities. They look for firms which not only have attractive research and development pipelines but also have products in the mid to final stages of clinical development. The team expects a holding’s portfolio weighting to double every four to five years as a result of clinical data, new product approvals and commercial launches. To find the best possible candidates, the team collectively meets with about 200 companies a year and carries out exhaustive analysis of a firm’s financial statements, competition, R&D pipelines, clinical data, competition and health economics.

Giving something back

Aside from searching for the long-term growth opportunities typically sought after by long-term institutional investors such as pension funds, an ongoing focus for BB Biotech has been broadening its appeal with an income element. Since 2013, the trust has incorporated a dividend policy that is designed to give shareholders a return of up to 10% a year. This consists of an annual dividend equal to a 5% return and share buybacks of up to 5% of share capital a year, provided trading is at a discount.

The big drivers

Despite recently edging into gene therapy, the bulk of BB Biotech’s portfolio remains invested in the oncology and orphan diseases sectors, where it allocated 30% and 26%, respectively, as of the end of Q1 2018. Biotech dominates new treatments in these sectors but the trust also has considerable capital in the neurological (16%), metabolic (12%), or infectious, and cardiovascular diseases (6% each) sectors, which points out that biotech’s multi-faceted nature means all sectors are fair game.

About BB Biotech AG

The Swiss investment trust listed on the Swiss, German and Italian Stock Exchange has a market capitalization of GBP 2.8 bn and invests in between 20 and 35 profitable biotech companies. As of the first quarter of 2018, the core portfolio included a 9.8% position in Ionis Pharmaceuticals, a 8.0% position in Incyte, a 7.7% position in Celgene, and a 7.3% position in Neurocrine Biosciences.

Disclaimer

Bellevue Advisors LLP is an appointed representative of Mirabella Advisers LLP, which is authorised and regulated by the Financial Conduct Authority. This advertisement is directed at professional clients and eligible counterparties as defined by the FCA in the UK only. Past performance is not indicative of future results.