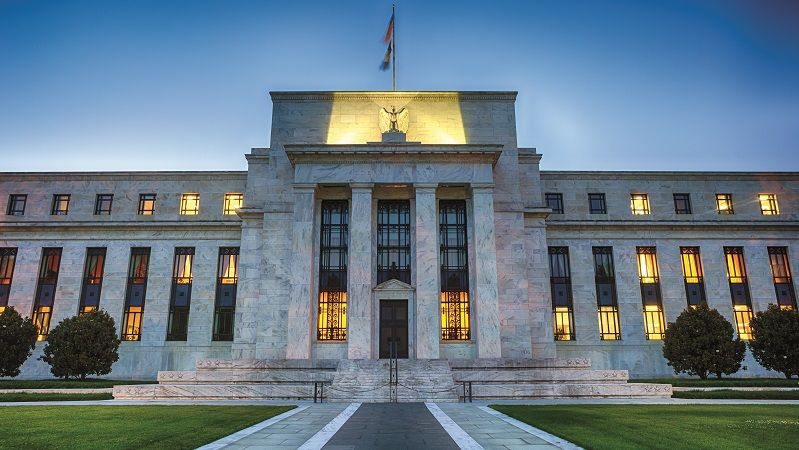

Record US debt: Will Fed consider cutting interest rates?

Democrats and Republicans may have reached agreement on a spending deal but ‘unsustainable’ levels of debt continue to be a cause for concern With another funding deadline looming, the Democrats and Republicans have reached a $1.66trn deal on US spending. This averts another potentially disruptive shut-down. Nevertheless, the level of US government debt remains a…