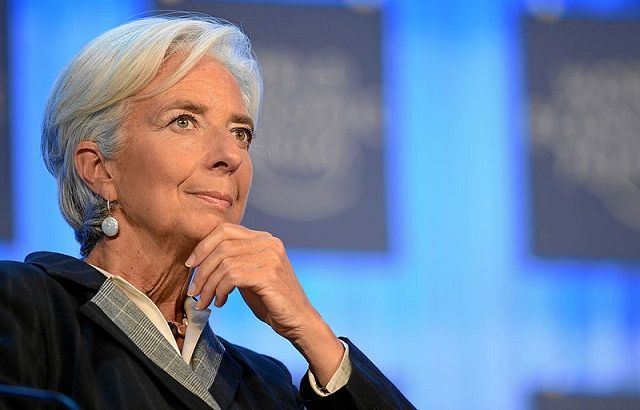

International Monetary Fund (IMF) head Christine Lagarde has been nominated – and is likely – to succeed Mario Draghi as president of the ECB when his eight-year term comes to an end in October.

The heads of EU member states last night confirmed their preferred candidates for a raft of top jobs, including the ECB, setting the potential future direction of the bloc for the next five years.

Italian Draghi’s eight-year period at the helm will be best remembered for his “whatever it takes” approach to propping up the eurozone during the European debt crisis.

“Christine Lagarde is stepping into a very large set of shoes at the ECB,” said Oliver Blackbourn, a portfolio manager at Janus Henderson.

The ECB Presidency is arguably perhaps the most difficult central banking job in the world. Europe remains an unfinished monetary and political union, with deep divides between regional blocs, and the region is in the midst of an awkward slowdown led by its largest economy, Germany.

German 10-year yields are close to the ECB’s deposit rate at -0.40% and Italy now has negative yields on its one-year debt.

“Hopefully Lagarde’s experience at the IMF will serve her well. However, there are concerns that the move out of this more structured, academic institution into the politically-fraught and ideologically-stretched ECB might be a difficult one, even for such a distinguished figure,” Blackbourn added.

“Lagarde will need to bring all of her connections and political nous to the job, and perhaps seek wide-ranging counsel on new economic policy responses given her lack of background in this area. Philip Lane, the new chief economist, is likely to be a key individual in this.”

Further stimulus likely

Fixed income markets have responded positively to the news, encouraged by the strong likelihood of a continuation of monetary easing as the baton passes from Draghi to Lagarde.

The main concern for markets had been an interruption of the return to accommodative policy Draghi has outlined for September, but a continuation and even expansion of easing is possible when Lagarde is expected to assume control in October.

“Having no central bank background, she will not have any preconceptions about what monetary policy should look like and will be largely unconstrained to pursue more adventurous forms of easing,” said David Zahn, head of European fixed income at Franklin Templeton.

“The appointment has reconfirmed the idea that the ECB will support the market over the short-to-mid-term at least. A continuation of quantitative easing means higher yielding debt will do well, including credit and peripheral debt, and we expect to see a continuation of the yield curve flattening. Italy and Spain are likely to be beneficiaries of further monetary easing, while we remain positioned for rate cuts in Europe.”

DeVere Group CEO Nigel Green agreed that that Lagarde is likely to share Draghi’s liking for aggressive and innovative monetary policy. “She is likely to insist on quantitative easing should inflation remain sluggish,” he said.

Evolving economic climate

Like Jerome Powell at the US Federal Reserve, Lagarde is a lawyer by training, meaning the two largest central banks will be run by non-economists for the first time.

“It reflects an evolving economic climate where central banks require a leader who is able to communicate effectively, while being unconstrained by having an economist background when reviewing innovative approaches to monetary policy,” Zahn said.

Blackbourn added that markets are likely to be relieved that the hawkish Jens Weidmann has missed out on the role.

“Weidmann has remained staunchly unconvinced by the innovations that have kept the eurozone barely ticking over. His nomination would have caused significant north-south splits and likely upset financial markets that have only just been buoyed by a Draghi pivot. There may be relief in the short term that the more dovish Lagarde has been nominated but she faces a very difficult challenge,” he said.