Lyxor has launched a megatrend ETF series which applies a combination of active and passive strategies, as well as artificial intelligence.

Arnaud Llinas, head of Lyxor ETF and indexing at Lyxor Asset Management, said the team takes a “dynamic approach” and is partnering with an advisory panel to take themes and adapt them in accordance with the “evolution” of these megatrends.

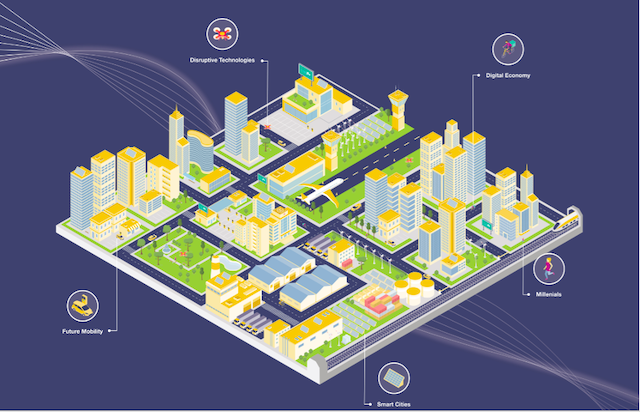

The five developed ETFs target key themes that are impacted by the following megatrends are: smart cities, digital economy, future mobility, disruptive technology and millennials.

They track theme-related MSCI indices, which are constructed by selecting stocks from the parent index, the MSCI Acwi Investable Market Index.

The index methodology employs a set of key words of theme-related products, services and concepts built using natural language processing and data analysis techniques. These key words help identify relevant companies based on the proportion of revenue that can be linked to the themes.

A group of experts retained by MSCI are consulted annually to help ensure the objective of each index and that associated sub-themes remain up-to-date to capture a particular trend.

Each index is filtered based on MSCI ESG Ratings, controversy scores and the exclusion of certain business activities, with final stock weights based on a combined score of three fundamental metrics: one-year sales growth, return on invested capital and % sales spent on R&D and capex.

Impact of covid-19

Lukas Neckermann, managing director of Neckermann Strategic Advisors, explained that covid-19 is expected to accelerate some of the themes reflected in the ETFs.

Looking at the mobility sector, he said: “We have consolidation and that is both within the value chain and across the value chain, in other words vertical and horizontal consolidation.

“We have a lot of consolidation activity going on right now and we have acceleration.”

He also noted that they have observed a very significant increase in the number of bike lanes and pedestrian zones that are being built in cities.

Meanwhile, Neckermann said that there are cities that have built up resiliency plans.

“You consider Seoul, Singapore, Taipei, these are cities that have been seen to emerge out of this a little bit more strongly and they are all considered amongst the smartest of cities.”

Lyxor’s smart city ETF, for example, invests 47.86% in information technology, 28.36% industrials, 10.81% communication services, 10.68% utilities, 1.16% in materials and 1.13% in energy.

Geographically, the holdings are mainly allocated to the US with 47.42%, followed by China with 9.18%, Japan (8.03%), Taiwan (6.33%), Switzerland (3.81%) and others.

The five launched ETFs are:

- Lyxor MSCI Smart Cities ESG Filtered,

- Lyxor MSCI Digital Economy ESG Filtered,

- Lyxor MSCI Future Mobility ESG Filtered,

- Lyxor MSCI Disruptive Technology ESG Filtered,

- Lyxor MSCI Millennials ESG Filtered.