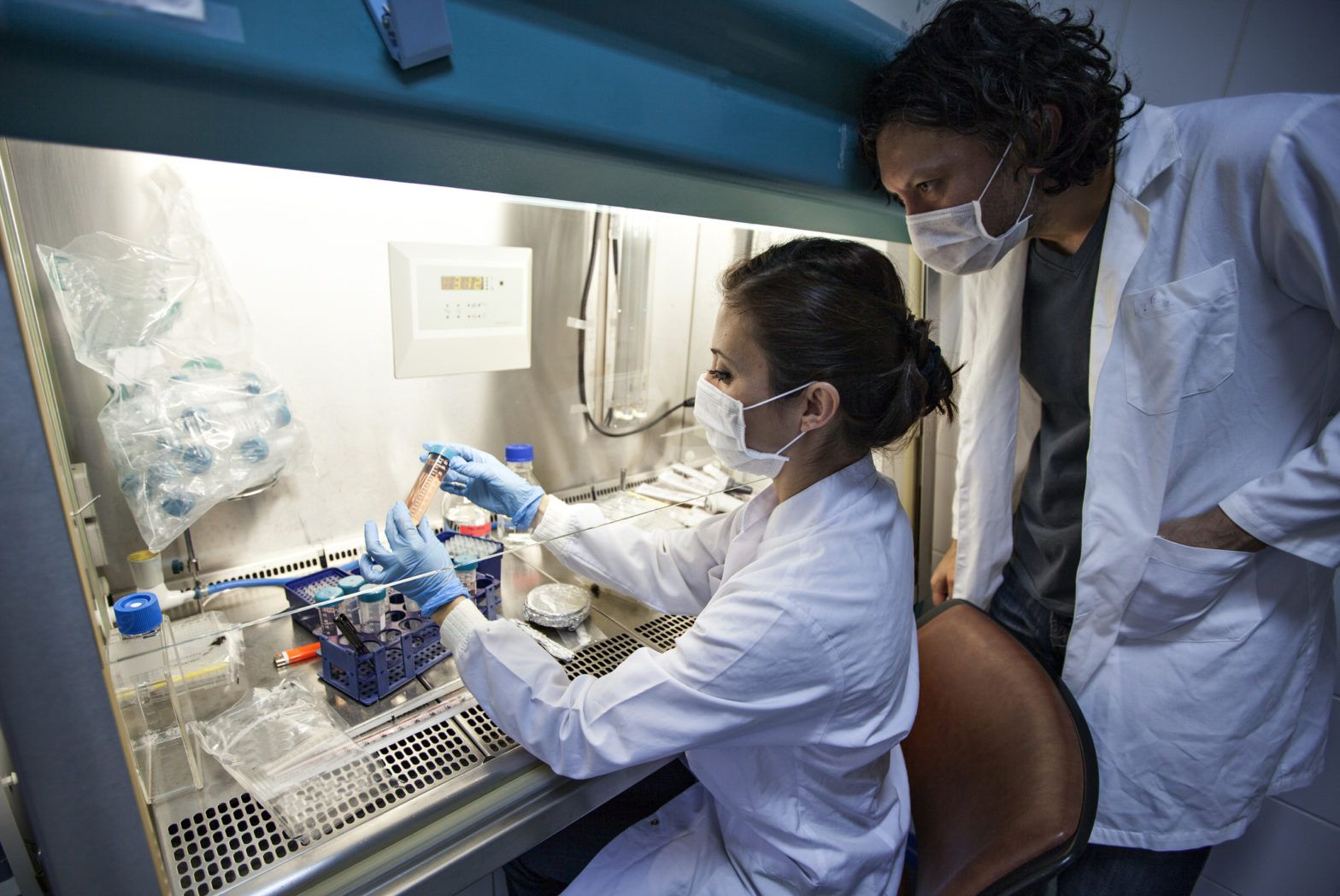

VC firm debuts investment strategy for European biotech startups

European venture capital firm Sofinnova has launched Biovelocita, an investment strategy dedicated to the creation and acceleration of biotech startups in Europe. The firm said it had a created a new team for Biovelocita and the new venture was inspired by Italy’s first biotech accelerator, BiovelocITA, co-founded by Gabriella Camboni, Silvano Spinelli and Sofinnova Partners…