Investor exodus from US diversified equity funds

Largest net outflows since 2008 while fixed income funds attract net inflows

ANNOUNCEMENT: Expert Investor is now PA Europe. Read more.

Largest net outflows since 2008 while fixed income funds attract net inflows

Covers green bonds, social bonds and sustainability-linked bonds or loans, as well equity market issuance and M&A deals

As ‘active funds don’t prove robust to volatility’

Financial data and analytics provider claims the methodology will apply ‘objective’ metrics

European ETF industry suffered net outflows for first since February 2016 as investors fret over global slowdown

Despite rebounding equities and low interest rates, fixed income funds were best-selling asset class in February

Slowing growth and shift in central bank rates policy could have impact on hybrid securities market

€62.3bn pulled from long-term funds, writes Detlef Glow, head of Lipper EMEA research at Refinitiv

Despite meagre returns, October saw the highest monthly flows into money market funds in over a decade at €52.5bn

Rating agencies at odds with UN body over ESG definition, EC sustainable framework decision key

Total fund sales for the first half of year across Europe was €59.8bn about six times lower than €362.4bn first-half sales in 2017. But ETF market share hits record high, according to Thomson Reuters Lipper data.

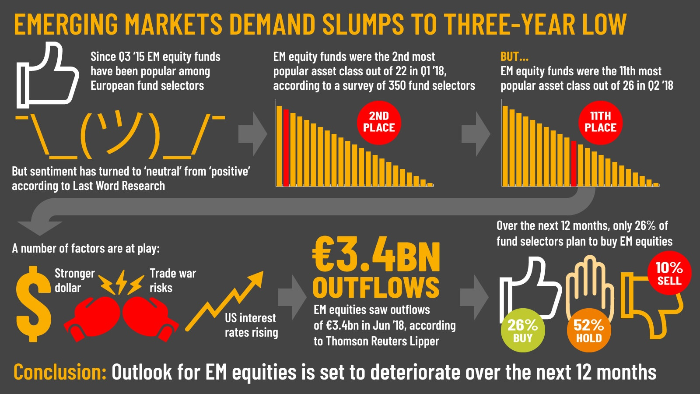

Global emerging market (GEM) equities have been one of the most popular asset classes among pan-European fund selectors since Q3 2015 – but demand dropped dramatically during Q2 2018.