Gregory Halton assesses the opportunities and risks of a sector that is suddenly making front-page news

The semiconductor sector is in the grip of a cyclical upturn, after being thrust onto the front pages as the impact of acute shortages of certain chips is felt in many industries. This shortage has highlighted the ever-growing importance of the semiconductor sector to the global economy and has also helped propel further gains for many stocks, building further on the strong returns seen in 2020.

The current up-cycle is due in large part to the impact of the Covid-19 pandemic, which caused an unexpected increase in demand for electronic devices to support working from home and increased demand for online activities. This has caused chip demand to run ahead of supply, requiring chipmakers to prioritise orders for the largest customers and the most lucrative products.

Combined with logistical issues and other factors, available supplies of some devices have run short, with severe knock-on impacts for the industries that were relying on them to manufacture their own products. Most visibly, many automakers have suspended vehicle production as it has become impossible to ship completed vehicles without the semiconductors needed to control key components in the vehicle.

Tight capacity has created unusually strong pricing conditions across the value chain, which stand in sharp contrast to the usual deflationary trend. While this is good news for the sector in the short term, investors must remain mindful the current tightness is unlikely to last, as chip-makers will inevitably respond to market and political pressures to raise production and alleviate shortages.

As long-term investors, our constructive investment thesis is aligned instead with the positive structural trends we believe will continue to create attractive opportunities within the sector even as the current cycle eases. Here we see three major positive features, two of which represent a departure from the past.

Market opportunity

First among these structural trends is the expectation of good ongoing growth rates in market opportunity. Spending and innovation continue apace, driving continual improvement in chip performance and more capable electronic devices.

This process continues to drive greater use of semiconductors within electronic devices and the addition of chips into an ever-wider range of everyday devices, as chip-enabled ‘smart’ items continue to replace their analogue equivalents. As digitisation and the adoption of the internet progresses, the quantity of data that is being collected, processed, transmitted and stored increases exponentially, driving the need for more chips.

Adoption of promising enabling technologies such as 5G communications and artificial intelligence are likely to accelerate the rapid growth in data in years to come. This will drive high demand for chips of all types but especially of the leading-edge devices required to unlock the full benefits of the innovation taking place in products and services. Demand for design services, foundry, memory and advanced packaging should naturally follow, supporting the positive growth outlook for the sector.

Greater concentration

The benefits of the industry’s past growth have not been evenly distributed. The inexorable increases in research and capital expenditure required to innovate within this sector have often led to superior and improving economics for market leaders and diminishing returns and market share for the rest. Combined with strong execution and appropriate levels of reinvestment, over time these economic pressures have forced the semiconductor industry to consolidate with the result that, today, we have a much higher degree of market concentration than in the past.

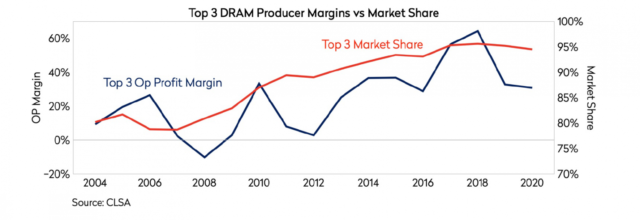

The DRAM memory industry, for example, has consolidated to three major players, the chip packaging industry is dominated by four companies and, within the logic foundry space, Taiwanese giant TSMC alone represents more than half of industry revenue.

The impact of this consolidation is visible in a trend toward higher and more stable margins over time, particularly for the market leaders who have generally enjoyed the highest and most stable returns. It is for this reason we have focused our holdings in those industry-leading companies, while avoiding the second-tier companies whose current profitability owes more to the current up-cycle than structural factors and where we see greater risk of disappointing returns from this point.

Greater consolidation has led to improved margins in DRAM

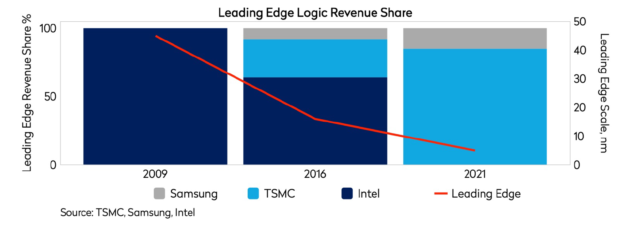

In a further break with the past, although certain US or Europe based companies like Nvidia or ASML continue to lead in some sub-sectors, it is noteworthy that, in many cases, technological leadership has passed to companies based in emerging markets, particularly in advanced manufacturing.

In foundry services, for example, TSMC has overtaken Intel in terms of technological advancement as well as scale, while its leadership has also spurred parallel opportunities in design, packaging and testing that benefit other Taiwanese companies, such as Alchip and ASE respectively. In memory chips, Samsung and Hynix have superior technology and profitability to rivals while, in the solar energy space, LONGi and other Chinese companies also enjoy a significant technological and scale advantage to other nations.

As such, while the industry is more consolidated than the past, key parts are also dominated by north Asian companies with a competitive edge that is built on technological leadership and scale that in turn leads to superior profitability.

Human capital

Looking ahead, the technological and financial barriers to achieving success in this industry continue to rise, while the US-China tensions have resulted in many Chinese would-be competitors being starved of access to the vital US-developed technologies that underpin innovation across the supply chain. Furthermore, Taiwan and Korea are now clearly the locations where much of the human talent vital to succeed in semiconductor manufacturing can most easily be found. Thus, the competitive stability should continue and the leadership position for such stocks should be self-reinforcing.

Leadership in the logic segment has shifted to Taiwan and Korea

With the recent chip shortages having highlighted the degree of concentration within the industry and its reliance on manufacturing based in Taiwan and Korea, geopolitical and trade concerns have risen up the political agenda in the US and Europe. This has led to calls to incentivise production to take place closer to end-markets and Intel, Samsung and TSMC have all announced multi-billion-dollar investment plans to build new plants in the US.

While this could lead to some easing of the current bottlenecks for legacy technologies, it is likely the new capacity being developed will simply replace new facilities that would instead have been constructed elsewhere, so we do not see this creating meaningful supply risk in the most important leading-edge technologies. Meanwhile, some diversification in supply locations is to be welcomed, particularly as ensuring water and land availability for expansion have become more challenging for Taiwanese groups.

The need to maintain technological leadership while building sufficient capacity to meet expected demand growth likely means the industry must accelerate investment further in the years ahead, but such investments should add value for selected stocks and can be comfortably funded from strong balance sheets and ongoing cashflows.

Recent newsflow has served to highlight the vital importance of the semiconductor industry to the global economy. As such, investors can expect good growth in revenue, profitability and cashflow and, while valuations for some stocks have run up lately, an attractive margin of safety can be identified in certain stocks. Overall, investors should continue to be watchful of risks within the sector linked to cyclicality, overinvestment, competition and geopolitics but the risk profile for market leaders appears relatively low.

Gregory Halton is a senior portfolio manager at Mondrian Investment Partners